Discover Airtel Money Charges: The Ultimate Guide

Airtel Money: Unlocking Financial Inclusion through Affordable and Convenient Mobile Money Services

Airtel Money is a mobile money service that allows users to send and receive money, make payments, and access financial services using their mobile phones. Introduced by Airtel, a leading telecommunications provider in Africa, Airtel Money has revolutionized the financial landscape in many countries, particularly in regions where traditional banking services are limited or inaccessible.

The key to Airtel Money's success lies in its affordability and convenience. With Airtel Money, users can perform various financial transactions at minimal costs, making it an accessible option for the unbanked and underbanked population. Additionally, the service's mobile-based platform eliminates the need for physical bank branches, allowing users to access financial services from anywhere with a mobile phone signal.

Airtel Money has played a significant role in promoting financial inclusion and economic development in many African countries. By providing access to essential financial services, Airtel Money has empowered individuals and small businesses, enabling them to participate more fully in the formal economy. The service has also contributed to increased financial literacy and awareness, fostering a culture of saving and investment among users.

In conclusion, Airtel Money has transformed the financial landscape in Africa by providing affordable, convenient, and accessible mobile money services. Its impact on financial inclusion and economic development has been profound, empowering individuals and businesses alike. As Airtel Money continues to expand its reach and introduce innovative features, it is poised to play an even greater role in shaping the future of finance in Africa.

Airtel Money Charges

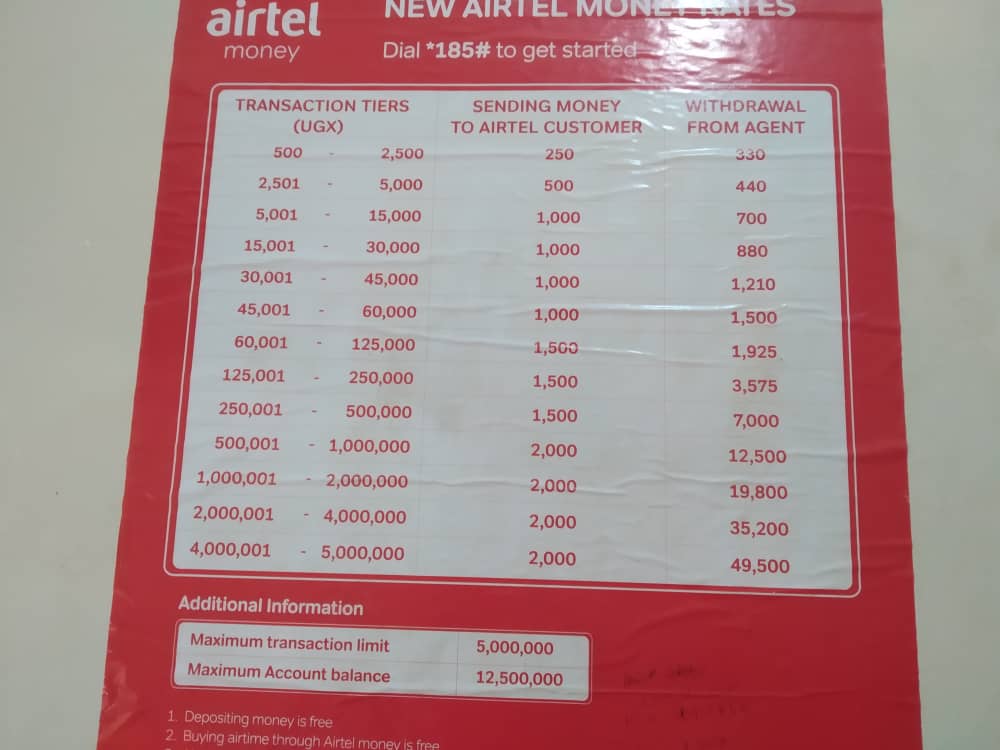

Airtel Money charges are a crucial aspect of the service, influencing its accessibility and affordability. Here are five key aspects to consider:

- Transaction fees: Charges incurred for sending and receiving money.

- Withdrawal fees: Charges applied when withdrawing cash from an Airtel Money agent.

- Airtime purchase fees: Charges for purchasing airtime or data bundles using Airtel Money.

These charges vary depending on factors such as the transaction amount, recipient's network, and agent location. It's important for users to be aware of these charges to budget accordingly and optimize their usage of Airtel Money services. Transparency and clarity in fee structures are essential for building trust and encouraging adoption of mobile money services.

Transaction fees

Transaction fees are a fundamental component of Airtel Money charges. These fees cover the costs associated with processing and facilitating money transfers between Airtel Money users. Understanding transaction fees is crucial for users to budget effectively and optimize their usage of the service.

Transaction fees vary depending on factors such as the amount being sent, the recipient's network, and the agent location. Airtel Money typically charges a percentage of the transaction amount as a fee, with minimum and maximum limits in place. For example, sending a small amount of money within the same network may incur a lower fee than sending a larger amount to a different network.

Transparency and clarity in transaction fees are essential for building trust and encouraging adoption of mobile money services. Airtel Money users should be fully aware of the fees associated with each transaction before initiating it. This allows them to make informed decisions about how and when to use the service, ensuring that it remains an affordable and accessible option for financial transactions.

Withdrawal fees

Withdrawal fees are an integral part of Airtel money charges, impacting the overall cost and accessibility of the service. Understanding withdrawal fees is crucial for users to make informed decisions about how and when to withdraw cash from their Airtel Money accounts.

- Transaction Costs: Withdrawal fees cover the costs associated with processing and facilitating cash withdrawals from Airtel Money agents. These fees vary depending on factors such as the amount being withdrawn, the agent location, and the time of day.

- Agent Commissions: Airtel Money agents earn a commission for each withdrawal transaction they process. This commission is typically included in the withdrawal fee charged to the user. The commission structure varies depending on the agent's location, operating costs, and agreement with Airtel.

- Convenience and Accessibility: Withdrawal fees must be balanced against the convenience and accessibility that Airtel Money agents provide. By having a wide network of agents, Airtel Money makes it easy for users to access their funds even in remote areas where traditional banking services may not be available.

- Impact on Financial Inclusion: Withdrawal fees can impact the financial inclusion of low-income earners and unbanked populations. High withdrawal fees may discourage users from using Airtel Money services, limiting their access to formal financial services and hindering their financial empowerment.

In conclusion, withdrawal fees are a significant component of Airtel money charges, influencing the cost, accessibility, and financial inclusion aspects of the service. Airtel strikes a balance between generating revenue, compensating agents, and maintaining affordability to ensure that Airtel Money remains a valuable financial tool for its users.

Airtime purchase fees

Airtime purchase fees are a crucial component of Airtel Money charges, influencing the overall cost and usage patterns of the service. Understanding these fees is essential for users to optimize their spending and maximize the benefits of Airtel Money.

Airtime purchase fees cover the costs associated with processing and facilitating the purchase of airtime or data bundles using Airtel Money. These fees vary depending on factors such as the amount being purchased, the network operator, and the time of day. Airtel Money typically charges a percentage of the purchase amount as a fee, with minimum and maximum limits in place.

The practical significance of understanding airtime purchase fees lies in enabling users to make informed decisions about how and when to purchase airtime or data bundles using Airtel Money. By being aware of the fees involved, users can compare costs with other options, such as purchasing directly from the network operator or using alternative payment methods. This allows users to optimize their spending and ensure that they are getting the best value for their money.

In conclusion, airtime purchase fees are an important aspect of Airtel Money charges that impact the cost and usage patterns of the service. Understanding these fees empowers users to make informed decisions, optimize their spending, and maximize the benefits of Airtel Money.

FAQs on Airtel Money Charges

This section addresses frequently asked questions regarding Airtel Money charges, providing clear and concise answers to common concerns or misconceptions.

Question 1: What are the different types of Airtel Money charges?

Airtel Money charges primarily include transaction fees, withdrawal fees, airtime purchase fees, bill payment fees, and merchant payment fees. Each type of charge covers the costs associated with specific services offered by Airtel Money.

Question 2: How are transaction fees calculated?

Transaction fees for Airtel Money transfers vary depending on factors such as the amount being sent, the recipient's network, and the transaction channel used. Airtel typically charges a percentage of the transaction amount, with minimum and maximum limits in place.

Question 3: Are there any charges for receiving money via Airtel Money?

Typically, there are no charges for receiving money into an Airtel Money account. However, charges may apply if the money is received from a different network or through a specific promotion or service.

Question 4: What factors influence withdrawal fees?

Withdrawal fees for Airtel Money cash withdrawals depend on the amount being withdrawn, the agent location, and the time of day. Airtel Money agents may charge a commission for their services, which is often included in the withdrawal fee.

Question 5: How can I minimize Airtel Money charges?

To minimize Airtel Money charges, users can consider sending money during off-peak hours, using Airtel Money agents with lower commissions, and taking advantage of promotions or discounts offered by Airtel.

Question 6: Where can I find more information about Airtel Money charges?

Detailed information about Airtel Money charges can be found on Airtel's official website, mobile app, or by contacting Airtel customer care.

Summary: Understanding Airtel Money charges is crucial for optimizing usage and managing expenses. By being aware of the different types of charges and the factors that influence them, users can make informed decisions and get the most value from Airtel Money services.

Conclusion

Airtel Money charges play a critical role in shaping the accessibility, affordability, and usage patterns of Airtel Money services. Understanding these charges empowers users to optimize their financial transactions, manage expenses effectively, and maximize the benefits of mobile money. Airtel strikes a balance between generating revenue, compensating agents, and maintaining affordability to ensure that Airtel Money remains a valuable financial tool for its users.

As Airtel Money continues to expand its reach and introduce innovative features, it is poised to play an even greater role in driving financial inclusion and economic development. By providing affordable, convenient, and accessible mobile financial services, Airtel Money is transforming the financial landscape, empowering individuals and businesses alike. The future of Airtel Money looks bright, with the potential to further revolutionize the way people manage their finances and participate in the digital economy.

Detail Author:

- Name : Dr. Gianni Gutmann

- Username : mgleason

- Email : bpfannerstill@ratke.com

- Birthdate : 1998-04-19

- Address : 785 Weissnat Estates Dessiefurt, ND 56535-0170

- Phone : +1 (302) 713-3387

- Company : Eichmann-Quigley

- Job : Model Maker

- Bio : Quo nostrum et magni quia laborum similique eius. Voluptas officia non vero velit. Et recusandae in ipsum commodi laudantium. Quia velit dolorum quo et repellendus.

Socials

facebook:

- url : https://facebook.com/juliethammes

- username : juliethammes

- bio : Ex magnam rerum maiores rerum. Et et laboriosam est voluptas.

- followers : 6979

- following : 890

linkedin:

- url : https://linkedin.com/in/juliet_hammes

- username : juliet_hammes

- bio : Similique et eum et.

- followers : 290

- following : 1009

twitter:

- url : https://twitter.com/juliet.hammes

- username : juliet.hammes

- bio : Quia atque qui excepturi nisi qui. Qui veniam ut veniam aliquam. A qui velit molestiae ipsam.

- followers : 4750

- following : 1359