Discover Withdrawal Charges On Airtel: A Comprehensive Guide

Wondering about withdrawal charges on Airtel?

When you withdraw money from your Airtel mobile wallet, you may be charged a fee. This fee is known as a withdrawal charge. The amount of the charge varies depending on the amount of money you are withdrawing and the method you are using to withdraw it. For example, withdrawing money from an Airtel ATM will typically incur a higher fee than withdrawing money from a bank account.

Withdrawal charges can be a nuisance, but they are important for Airtel to cover the costs of providing the service. Without these charges, Airtel would not be able to offer mobile money services to its customers.

If you are concerned about withdrawal charges, there are a few things you can do to minimize them. First, try to withdraw money from an Airtel ATM whenever possible. Second, try to withdraw larger amounts of money less frequently. Finally, consider using a different mobile money service that offers lower withdrawal charges.

Withdrawal Charges Airtel

Withdrawal charges are fees levied by Airtel when customers withdraw money from their Airtel mobile wallets. These charges can vary depending on the amount of money withdrawn and the withdrawal method used.

- Amount: The amount of the withdrawal charge is determined by the amount of money being withdrawn. The higher the amount, the higher the charge.

- Method: The withdrawal method also affects the charge. Withdrawing money from an Airtel ATM typically incurs a higher charge than withdrawing money from a bank account.

- Frequency: Withdrawing money less frequently can help to minimize withdrawal charges.

- Alternatives: There are other mobile money services that offer lower withdrawal charges than Airtel.

- Convenience: Airtel ATMs are widely available, making it convenient to withdraw money from Airtel mobile wallets.

- Security: Airtel ATMs are secure, making it safe to withdraw money from Airtel mobile wallets.

- Customer service: Airtel provides excellent customer service, which can be helpful if you have any questions about withdrawal charges.

Withdrawal charges can be a nuisance, but they are important for Airtel to cover the costs of providing the service. Without these charges, Airtel would not be able to offer mobile money services to its customers.

If you are concerned about withdrawal charges, there are a few things you can do to minimize them. First, try to withdraw money from an Airtel ATM whenever possible. Second, try to withdraw larger amounts of money less frequently. Finally, consider using a different mobile money service that offers lower withdrawal charges.

Amount

The amount of the withdrawal charge is determined by the amount of money being withdrawn because Airtel needs to cover the costs of providing the service. These costs include the cost of maintaining the Airtel mobile money platform, the cost of processing withdrawal transactions, and the cost of providing customer service. The higher the amount of money being withdrawn, the higher the costs for Airtel, and therefore the higher the withdrawal charge.

For example, if you withdraw 100 rupees from your Airtel mobile wallet, you may be charged a withdrawal fee of 5 rupees. However, if you withdraw 1,000 rupees from your Airtel mobile wallet, you may be charged a withdrawal fee of 10 rupees. This is because the cost of processing a 1,000 rupee withdrawal is higher than the cost of processing a 100 rupee withdrawal.

It is important to be aware of the withdrawal charges that apply to your Airtel mobile wallet before you make a withdrawal. This will help you to avoid any unexpected fees. You can find the withdrawal charges for your Airtel mobile wallet on the Airtel website or by contacting Airtel customer service.

Method

The withdrawal method you choose can affect the withdrawal charge you are charged. Withdrawing money from an Airtel ATM typically incurs a higher charge than withdrawing money from a bank account. This is because Airtel ATMs are more expensive to operate than bank ATMs. Airtel must cover the costs of maintaining the ATMs, processing the withdrawal transactions, and providing customer service. These costs are passed on to the customer in the form of a higher withdrawal charge.

- Convenience: Airtel ATMs are more convenient than bank ATMs. They are located in more places, and they are open 24 hours a day, 7 days a week. This makes it easier for customers to access their money when they need it.

- Security: Airtel ATMs are secure. They are equipped with security cameras and other security features to protect customers from fraud and theft.

- Transaction limits: Airtel ATMs typically have lower transaction limits than bank ATMs. This means that customers may need to make multiple withdrawals to get the amount of money they need.

Ultimately, the best withdrawal method for you will depend on your individual needs and preferences. If you value convenience and security, then you may be willing to pay a higher withdrawal charge to use an Airtel ATM. However, if you are on a tight budget, then you may want to choose a less convenient withdrawal method, such as withdrawing money from a bank account, to avoid paying a higher withdrawal charge.

Frequency

Withdrawing money less frequently can help to minimize withdrawal charges because it reduces the number of times that Airtel has to process a withdrawal transaction. This saves Airtel money, which it can then pass on to its customers in the form of lower withdrawal charges.

- Convenience: Withdrawing money less frequently may be less convenient, as you will need to plan ahead to ensure you have enough cash on hand. However, if you are on a tight budget, the savings on withdrawal charges may be worth the inconvenience.

- Transaction limits: If you have a large amount of money to withdraw, you may need to make multiple withdrawals if you are withdrawing money less frequently. This is because Airtel ATMs typically have lower transaction limits than bank ATMs.

Ultimately, the best withdrawal frequency for you will depend on your individual needs and preferences. If you value convenience and are willing to pay a higher withdrawal charge, then you may want to withdraw money more frequently. However, if you are on a tight budget and are willing to plan ahead, then withdrawing money less frequently can help you to minimize withdrawal charges.

Alternatives

Many mobile money services offer lower withdrawal charges than Airtel. This can be a significant savings, especially if you withdraw money frequently. For example, M-Pesa, a mobile money service in Kenya, charges a withdrawal fee of just 1% of the withdrawal amount. This is significantly lower than Airtel's withdrawal fee of 5%. As a result, many Airtel customers are switching to M-Pesa to save money on withdrawal charges.

The availability of alternative mobile money services with lower withdrawal charges has put pressure on Airtel to reduce its own withdrawal charges. In response, Airtel has introduced a number of new features to its mobile money service, including the ability to withdraw money from Airtel ATMs without a card. This has made it more convenient for customers to withdraw money from their Airtel mobile wallets. However, Airtel's withdrawal charges are still higher than those of many other mobile money services.

If you are an Airtel customer and you are concerned about withdrawal charges, you should consider switching to a different mobile money service. There are a number of other mobile money services that offer lower withdrawal charges, and many of them offer the same features and benefits as Airtel. By switching to a different mobile money service, you can save money on withdrawal charges and still enjoy the convenience of mobile money.

Convenience

The convenience of Airtel ATMs is a major factor in the popularity of Airtel's mobile money service. Airtel ATMs are located in more places than bank ATMs, and they are open 24 hours a day, 7 days a week. This makes it easy for customers to access their money when they need it.

The convenience of Airtel ATMs is especially important for customers who live in rural areas or who do not have access to a bank account. For these customers, Airtel ATMs are often the only way to withdraw money from their mobile wallets.

However, the convenience of Airtel ATMs comes at a price. Airtel charges a higher withdrawal fee than many other mobile money services. This is because Airtel has to cover the costs of maintaining the ATMs and processing the withdrawal transactions.

Despite the higher withdrawal charges, many customers are willing to pay for the convenience of Airtel ATMs. For these customers, the convenience of being able to withdraw money from an ATM outweighs the cost of the withdrawal fee.

The convenience of Airtel ATMs is a major advantage of the Airtel mobile money service. However, customers should be aware of the higher withdrawal charges before using an Airtel ATM.

Security

The security of Airtel ATMs is an important factor to consider when evaluating withdrawal charges. Airtel ATMs are equipped with a number of security features to protect customers from fraud and theft. These features include security cameras, PIN pads, and anti-skimming devices. Airtel also has a team of security experts who monitor ATM transactions for suspicious activity.

The security of Airtel ATMs is important because it helps to protect customers from losing money to fraud and theft. This is especially important for customers who withdraw large amounts of money from ATMs. The security features of Airtel ATMs help to deter criminals from targeting these machines. As a result, Airtel customers can feel safe when withdrawing money from Airtel ATMs.

The security of Airtel ATMs is a valuable service that helps to protect customers from financial loss. While Airtel does charge a withdrawal fee, this fee is worth paying for the peace of mind that comes with knowing that your money is safe.

Customer service

Excellent customer service is an important component of withdrawal charges airtel because it helps customers to understand and resolve any issues they may have with withdrawal charges. Airtel's customer service team is available 24/7 to answer questions and help customers with any problems they may encounter. This is important because withdrawal charges can be complex and confusing, and having access to reliable customer service can help to ensure that customers are not overcharged.

For example, a customer may not understand why they were charged a certain withdrawal fee. They may contact Airtel's customer service team to get an explanation. The customer service team can then explain the fee and help the customer to avoid being charged the fee in the future. This can save the customer money and help to build trust between the customer and Airtel.

Overall, excellent customer service is an important part of withdrawal charges airtel because it helps customers to understand and resolve any issues they may have with withdrawal charges. This can save customers money and help to build trust between customers and Airtel.

Withdrawal Charges Airtel FAQs

Here are some frequently asked questions about withdrawal charges on Airtel.

Question 1: What are withdrawal charges?

Withdrawal charges are fees levied by Airtel when customers withdraw money from their Airtel mobile wallets.

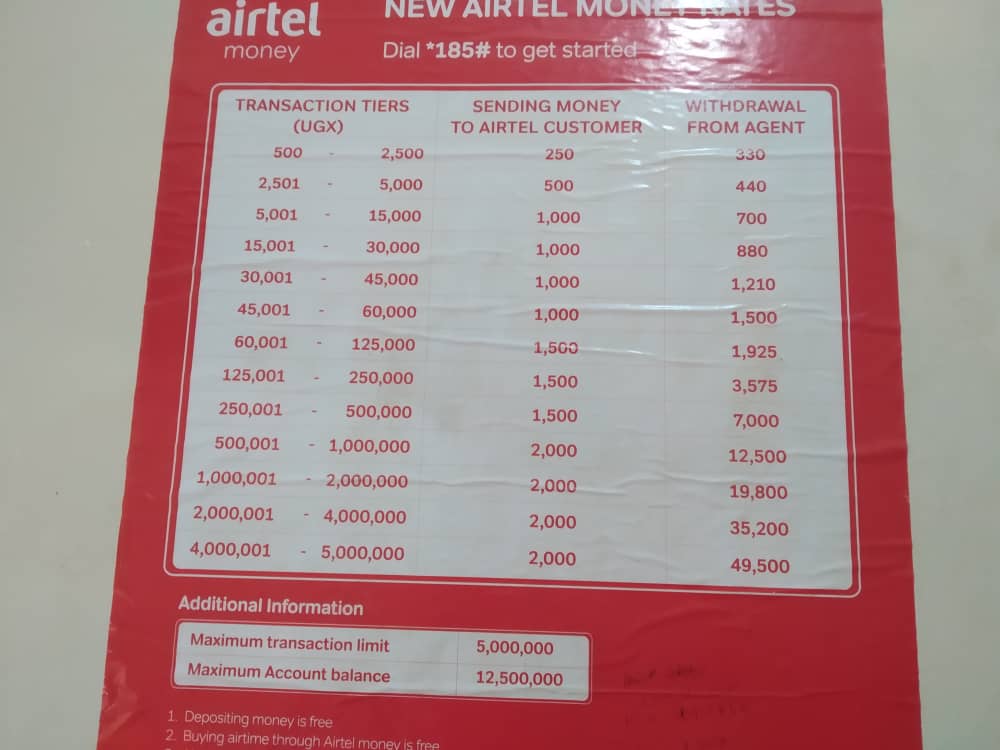

Question 2: How much are withdrawal charges?

The amount of the withdrawal charge varies depending on the amount of money being withdrawn and the withdrawal method used.

Question 3: Why does Airtel charge withdrawal charges?

Airtel charges withdrawal charges to cover the costs of providing the service. These costs include the cost of maintaining the Airtel mobile money platform, the cost of processing withdrawal transactions, and the cost of providing customer service.

Question 4: How can I avoid withdrawal charges?

There are a few things you can do to avoid withdrawal charges. First, try to withdraw money from an Airtel ATM whenever possible. Second, try to withdraw larger amounts of money less frequently. Finally, consider using a different mobile money service that offers lower withdrawal charges.

Question 5: What are the benefits of using Airtel ATMs?

Airtel ATMs are convenient and secure. They are located in more places than bank ATMs, and they are open 24 hours a day, 7 days a week. Airtel ATMs also have a number of security features to protect customers from fraud and theft.

Question 6: What should I do if I have a problem with withdrawal charges?

If you have a problem with withdrawal charges, you should contact Airtel customer service. Airtel's customer service team is available 24/7 to answer questions and help customers with any problems they may encounter.

We hope this helps! If you have any other questions, please feel free to contact us.

Next: What is Airtel Money?

Conclusion

In this article, we have explored the topic of withdrawal charges on Airtel. We have discussed the different factors that affect withdrawal charges, including the amount of money being withdrawn, the withdrawal method used, and the frequency of withdrawals made. We have also explored the benefits of using Airtel ATMs, such as their convenience and security. Finally, we have answered some frequently asked questions about withdrawal charges on Airtel.

We hope this article has been helpful in providing you with a better understanding of withdrawal charges on Airtel. If you have any further questions, please do not hesitate to contact Airtel customer service.

As mobile money services continue to grow in popularity, it is important for customers to be aware of the different fees that may be associated with these services. Withdrawal charges are just one of the fees that customers should be aware of. By understanding the different factors that affect withdrawal charges, customers can take steps to minimize these charges and get the most out of their mobile money service.

Detail Author:

- Name : Richmond Hessel

- Username : benton50

- Email : cdonnelly@gmail.com

- Birthdate : 1998-04-02

- Address : 5779 Crist Orchard Apt. 523 West Wendellshire, GA 62950

- Phone : +1.757.705.3075

- Company : Gutkowski Ltd

- Job : Sketch Artist

- Bio : Quidem animi inventore ipsa culpa velit. Dolorum corporis voluptatum porro corrupti praesentium enim delectus. Commodi quia minima non nulla quae autem distinctio.

Socials

tiktok:

- url : https://tiktok.com/@junior_dev

- username : junior_dev

- bio : Voluptas et non asperiores vitae iusto ipsa aliquid quia.

- followers : 5880

- following : 2867

linkedin:

- url : https://linkedin.com/in/junior_xx

- username : junior_xx

- bio : Est laudantium commodi dicta ea tenetur ut.

- followers : 6566

- following : 2230

facebook:

- url : https://facebook.com/junior1419

- username : junior1419

- bio : Illum quis suscipit repellendus enim dolorem.

- followers : 2730

- following : 2720

twitter:

- url : https://twitter.com/junior9578

- username : junior9578

- bio : Aut consequatur consequatur ipsam qui. Nihil sequi ratione facere ut ipsa. Quas corporis repellendus minima et doloribus quo voluptas.

- followers : 3857

- following : 2362